All you need to know about Insurance Domain before developing IT!

First Things First- Why Domain Knowledge Matters?

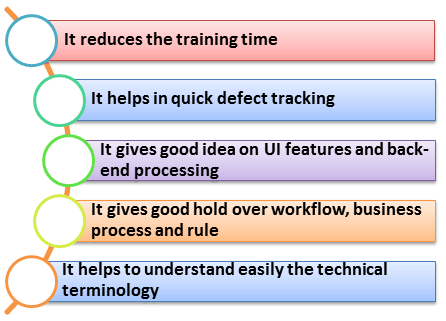

Domain knowledge is essential for Creating/testing/Implementing any software product, and it has its own benefits like

What is Insurance? Type of Insurance

Insurance is defined as the equitable transfer of the risk of a loss from one entity to another in exchange for payment.

Insurance Company, which sells the policy is referred to as INSURER while the person or company who avails the policy is called the INSURED.

Insurance policies are usually classified into two categories, and insurer buys the policies as per their requirement and budget.

What is Premium?

Premium is defined as the amount to be charged for a certain amount of insurance coverage or policy the insured has bought.

Premium for the insurance is determined by on the basis of two factors

- The frequency of claims

- The Severity of claims (Cost of each claim)

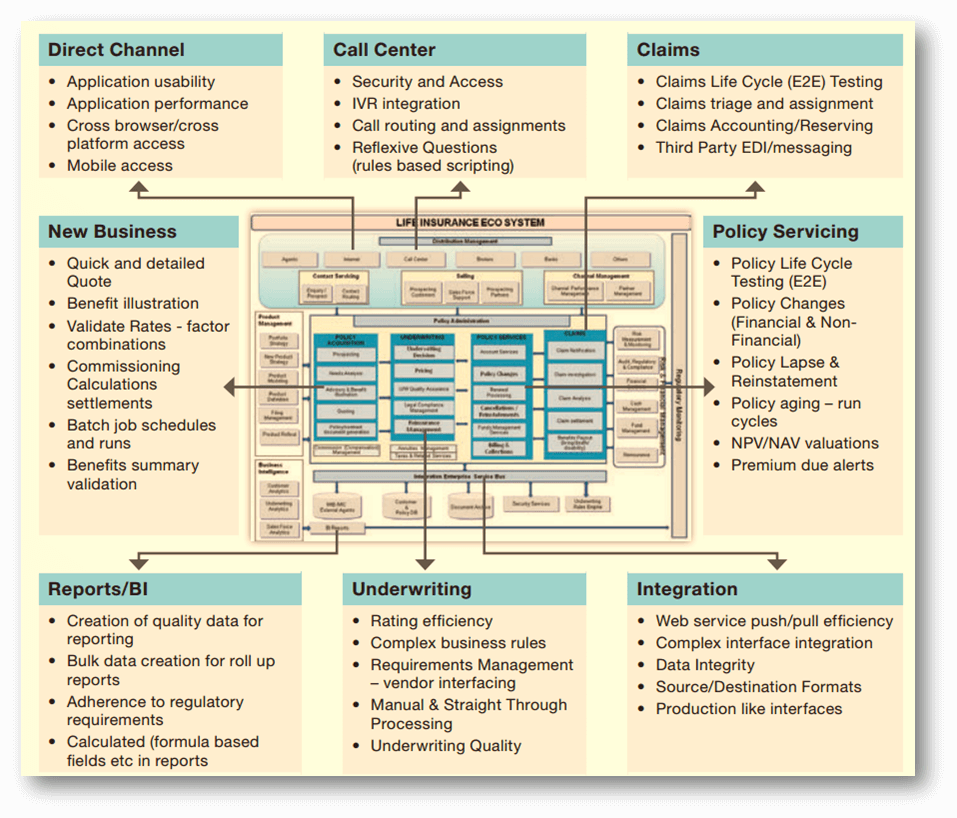

Different process area of Insurance:

Systems which comes to play in an Insurance company.

- Policy Administration Systems

- Claim Management Systems

- Distribution Management Systems

- Investment Management Systems

- Third party Administration Systems

- Risk Management Solutions

- Regulatory and Compliance

- Actuarial Systems (Valuation & Pricing)

Have a look at High-level Architecture of ecosystem

Elaboration

The insurance sector is a network of small units that deals directly or indirectly with processing claims.

For the smooth functioning of an insurance company, it is necessary that each of this unit is developed with precision and understanding the use case and tested rigorously before it is sync together to deliver the desired outcome.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary

Timely process of the insurance policy and managing client's data is a foremost priority for any insurance company. Their complete dependency on a software solution for handling claims, as well as customers, requires software solution to be precise and accurate. Considering all the key aspects of insurance company's requirement some of the general domain understanding and scenarios are represented in the blog.

Comments

Post a Comment